Payhawk

Über Payhawk

Payhawk Preis

Payhawk bietet keine Gratisversion und keine kostenlose Testversion.

Alternativen für Payhawk

Alle Bewertungen zu Payhawk Filter anwenden

Nutzerbewertungen zu Payhawk durchsuchen

Alle Bewertungen zu Payhawk Filter anwenden

- Branche: Bekleidung & Mode

- Unternehmensgröße: 1.001–5.000 Mitarbeiter

- Monatlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

A Comprehensive Financial Management Solution

My experience with Payhawk has been overwhelmingly positive. It has streamlined our financial processes, reduced manual work, and provided valuable insights into company spending. Highly recommended for businesses looking to modernize their financial operations.

Vorteile

What I liked most about Payhawk is its seamless integration of expense management, corporate cards, and accounting. The platform is incredibly user-friendly, and the real-time tracking feature helps maintain full control over company spending.

Nachteile

What I liked least was the occasional delay in customer support response times. While the platform is robust, quicker support would enhance the overall experience, especially during urgent issues.

- Branche: Finanzdienstleistungen

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great All-In-One Solution

Great product, especially for companies with entities in different countries and having to pay in multiple currencies.

Vorteile

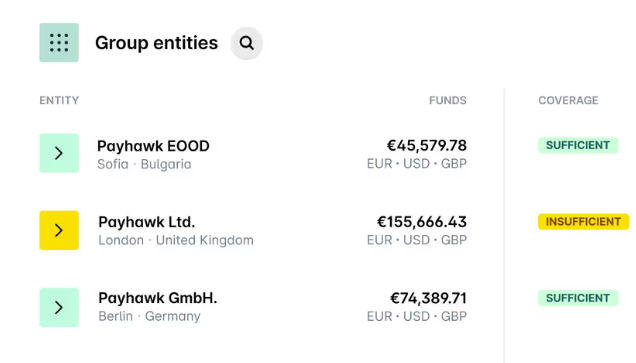

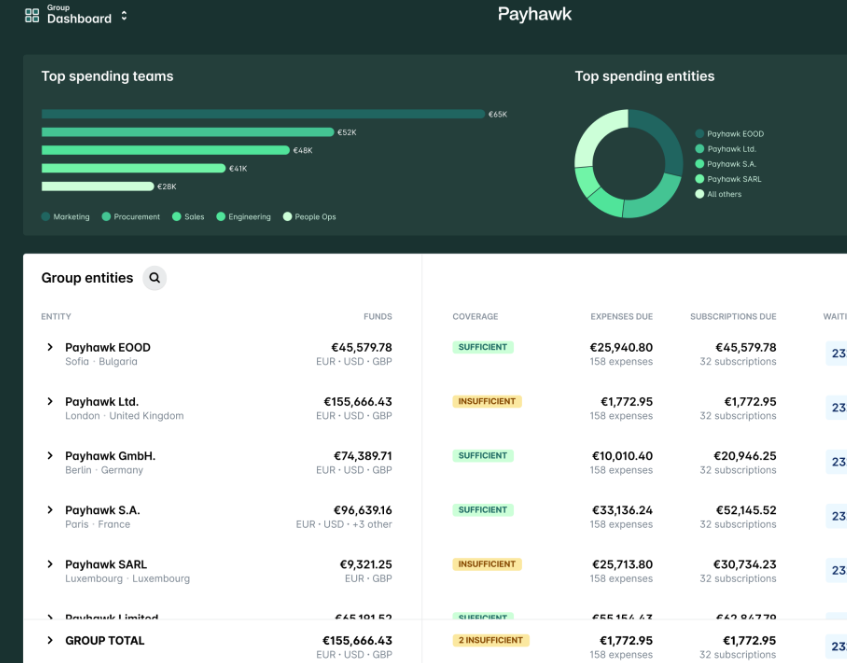

- Can be used for multiple entities and provides several currency wallets and payments

- Accounting integrations (Xero, DATEV)

- Easy to set-up

- Multiple features besides spend management such as expense management

Nachteile

- receipt forwarding only works for user accounts

- would be great to be able to deduct non-compliant payments directly from the Employee

Warum Payhawk gewählt wurde

needed an All-in-One Tool incl. Expense Management and being able to have multiple entities with different currenciesGründe für den Wechsel zu Payhawk

Better overall product, price/value comparison and ease of use- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 11–50 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Decent platform but approval workflows and invoice matching need some work

Works ok for multi-entity, very easy to issue, manage and use cards, AP is ok, reimbursements are good

Vorteile

Good multi entity AP/expense management. Additional users don't cost extra unlike some other expense platforms so we can have more non-card users on the platform for reimbursements etc, Cash back on card spend

Nachteile

Approval workflows are a bit clunky, receipt match is not very good (probably get a 50% match rate)

In Betracht gezogene Alternativen

SpendeskWarum Payhawk gewählt wurde

Pleo expensive and not very good, cost extra to add non card user for reimbursements, AP didn't workZuvor genutzte Software

PleoGründe für den Wechsel zu Payhawk

Cash back made the product significantly cheaper for effectively the same product features- Branche: Hausmeisterservice

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Brilliant - can't recommend enough

We have been well supported, right from the set up stage. The system is really easy to use, the how guides have been really useful when we did get stuck on something, and your customer service is responsive and helpful. Having recently moved over from one of your competitors, Payhawk is hands down the leading spend card system for us

Vorteile

Really easy to use. Our guys on the road were up and running with minimal training because it was so intuitive. The ability to have virtual cards means that new starters aren't having to submit expense claims any more.

Nachteile

Would be nice to be able to hide some of the payment categories depending on users. Not all staff need to see Office expense categories, for example.

- Branche: Computer-Software

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk: The best platform for a Euro-First Team

-overall i'm really happy with the platform and do not plan to switch. the UI is fairly enjoyable to work within the platform as an admin and user. Lots of setting functionalities for all sorts of use cases

Vorteile

-Multi-subsidiary management

-group settings roll-up for multi-entity management

-Workflow design builder

-US line of credit functionalitites

-Cash Back

-Netsuite Integration works very well

Nachteile

-Recurring bugs with settings during software updates

-set-up can be challenging

Warum Payhawk gewählt wurde

Price & netsuite integration & multi-entity management & US Line of credit. We closed two softwares into 1. Cledara & SpendeskZuvor genutzte Software

SpendeskGründe für den Wechsel zu Payhawk

Price & netsuite integration & multi-entity management & US Line of credit. We closed two softwares into 1. Cledara & SpendeskAntwort von Payhawk

Thank you for the detailed review! We're glad to hear that Payhawk's multi-entity management and integrations have been a great fit, and we’ll keep working to address any bugs and make setup easier. 😊

- Branche: Verbraucherdienste

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Excellent tool for expenses management

The overall experience is positive, it allows to manage all the expenses in a simple way and effective. It also has a good synchronization with many ERP systems.

Vorteile

It is easy to handle to all the receipts and invoices and centralize everything in one single space in a user-friendly dashboard.

Nachteile

I would like to be able to make transfers internationally to all countries. There are some invoices from certain countries for which I have to use a regular bank to pay the invoice that is already in Payhawk. If Payhawk opens the possibility of sending the money directly from Payhawk worldwide it would be great.

In Betracht gezogene Alternativen

SpendeskWarum Payhawk gewählt wurde

Payhawk offers a better solution in comparison to other products.Zuvor genutzte Software

Revolut BusinessGründe für den Wechsel zu Payhawk

Payhawk was more efficient in comparison to other products.- Branche: Marketing & Werbung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Love using payhawk!

brilliant, it has been a game changer for my companies expenses, makes my working month so much quicker now expenses are easy!

Vorteile

how easy it is to use the system, it was very quick to get set up

Nachteile

there is nothing i don't like about payhawk.

In Betracht gezogene Alternativen

SpendeskGründe für den Wechsel zu Payhawk

payhawk was the best all round and seemed to have all the functions i wanted to use- Branche: Computer-Software

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good experience so far, promising pipeline

Promising - pipeline looks exciting and we are keen to grow with you

Vorteile

Easy to use and becoming more configurable as we scale

Nachteile

The API integration is relatively complex and based on subscribing for events.

In Betracht gezogene Alternativen

NavanGründe für den Wechsel zu Payhawk

UI was much more intuitive and useable. We also liked the cash-back programme- Branche: Computer-Software

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Nice tool for complex usage

good but could be better. Today with low code possibility, people want to have a plug and play or slide and use configuration

Vorteile

cross entity work is very easy to do on this tool

Nachteile

Its complicated to work in settings - its not plug and play

- Branche: Computer-Software

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great overall experience

Great help of the team to implement the solution, we change from spendesk to payhawk and we are very happy with it

Vorteile

Easy to use, good client support if needed

Nachteile

Sometimes workflows are a little bit hard to understand at first

- Branche: Immobilien

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Organised Payments

we feel that we are in the right direction. i recommended Payhawk to 2 friends already.

Vorteile

the flexibility on limits, the control of spending, the organization of documents, and their support team. I feel that this will grow and the sky is the limit.

Nachteile

we are still setting up the automation of posting in our accounts software. the initial registration with some employees by not receiving the email and some went to junk mail. but once set all was good.

In Betracht gezogene Alternativen

Revolut BusinessGründe für den Wechsel zu Payhawk

Revolut business didn't offer the service in our country.- Branche: Informationsdienst

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Tool with great potential

Vorteile

It's a tool that has a lot of potential with many ease features. The interface is user friendly and the virtual payment methods are a lifesaver!

Nachteile

The integration with Exact has not been flawless and there is no real monthly expense reports per employee that can be generated. Each and every expense is separate and that makes it confusing.

- Branche: Kunst & Handwerk

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Easy to use convenience automation

Overall, I am highly satisfied with my experience with Payhawk. I would recommend this service to other business owners to help with their daily business processes

Vorteile

What I like most about Payhawk Is that it easily automates my spending invoicing, and Bill pay. Payhawk Has an easy to use user intervals. It is easy to learn, and teach new users to learn , how to use everything neede To streamline daily tasks in my company . I like that multiple languages are available, making it easy to communicate with everyone easily.

Nachteile

There is not a feature about hawks that I like the least. It could be easier to find FAQs that are commonly asked.

- Branche: Computer-Software

- Unternehmensgröße: 1.001–5.000 Mitarbeiter

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk saves time

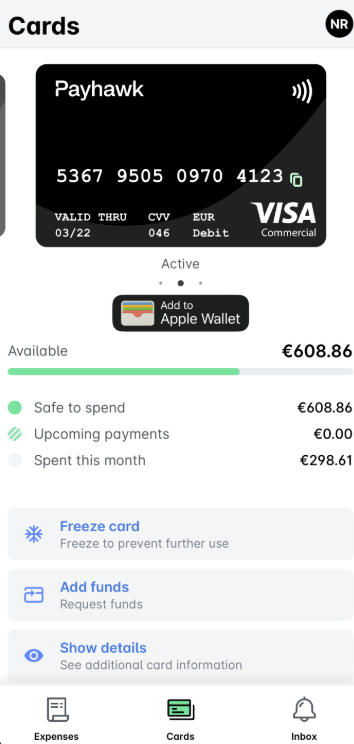

I like the virtual card experience. It helps to add the card to they payment methods and use it without any additional manual information entering while purchasing.

Vorteile

It helps to pay for things from my learning budget, e.g., buying books whenever needed. Even though it could be better, the auto-classification of the purchases saves time.

Nachteile

When I get a refund (e.g. a lost package from Amazon), I still have to upload the refund invoice even though the transfer to the card already contains all the information.

- Branche: Gesundheit, Wellness & Fitness

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk review

My experience with Payhawk has always been positive and assistance is always close by whenever i have needed it. The support is great and queries answered in a extremely timely fashion.

Vorteile

Payhawk is usually quite reliable in terms of connectivity but i do like the easy on the eye format the most.

Nachteile

What i like the least is when i purchase an Amazon product it can take half a day or so for the transaction to show up on Payhawk.

Antwort von Payhawk

Thank you for your review! We're glad to hear you’ve had a positive experience with Payhawk and appreciate the support. we’ll look into improving transaction visibility for Amazon purchases. 😊

- Branche: Medizinische Geräte

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Major Upgrade

Payhawk was a complete upgrade from our previous system, cardhoilders are now able to code and submit corporate card and business expenses instantky and comfortably from their preferred device

Vorteile

User friendly features and complete implementation to ERP system

Nachteile

So far I cannot complain about anything, they system is brilliant from its features to custome care

- Branche: Automotive

- Unternehmensgröße: 1.001–5.000 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great solution to improve productivity!

The company in which I'm working made a huge improvement thanks to PayHawk, the process become easier and more user friendly. Good!

Vorteile

Simplicity and integration with credit card and in the company systems. User friendly interface.

Nachteile

No particular painpoints to underline, it's a great service.

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 201–500 Mitarbeiter

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Very user friendly, intuitive and easy to use payment method for any business

Payments online and in-store are very quick and easy to handle. The expense submission and tracking is a big optimization for any small or large scale business.

Very intuitive and easy to use interface on desktop and mobile with lots of options for customization fitting your business needs.

Adding new cards and their physical receival is very quick.

Support are responsive and helpful. The documentation is well written and easy to follow.

Vorteile

Very user friendly and intuitive interface

Nachteile

Had an error with first payment on POS although following instructions. It was quickly resolved.

- Branche: Glücksspiel & Casinos

- Unternehmensgröße: 201–500 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk Review

Vorteile

It's easy to use and reliable. I like that i can have it on my apple pay as its convenient.

Nachteile

The only downside I have encountered with payhawk is I can't buy video games but besides that everything is great!

- Branche: Computer-Software

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Luke S. Review

Vorteile

Receipt collection from users and issuance of debit cards

Nachteile

When claiming per diems, if the location is not applied specifically to the city (eg. London) but to a specific address (eg. Tower Bridge, London), the UK generic rate is picked and not the London rate.

Gründe für den Wechsel zu Payhawk

Enough features to cover what we need- Branche: Finanzdienstleistungen

- Unternehmensgröße: 201–500 Mitarbeiter

- Monatlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Makes Invoicing Super Easy

Vorteile

It's easy to put up my invoices and tell my employer to pay what is due. It's a no-brainer.

Nachteile

Until I get paid, the invoice gets marked red as I'm waiting instead of having a certain notification that it's in the approval process.

Antwort von Payhawk

Thanks for sharing your thoughts! We're glad Payhawk makes invoicing easy for you, and we’ll take your feedback on invoice status notifications into account for future improvements. 😊

- Branche: Internet

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great spend solution

Vorteile

Automatic integration of expenses with the ERP, I've tried other tools and they do not reach the level of payhawk. They also have an excellent support team

Nachteile

I have not been using it for long (less than 6 months) but so far when there is a problem, they know how to respond.

- Branche: Marketing & Werbung

- Unternehmensgröße: 201–500 Mitarbeiter

- Monatlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Wonderful system

Payhawk is fantastic for an organisation where people are working remotely.

Vorteile

The security of the system and ease of use

Nachteile

Im sometimes unaware if I have done what I need to do correctly.

- Branche: Bau

- Unternehmensgröße: 201–500 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Should have had this solution earlier

Vorteile

Easy to use, and very flexible.

I love the API. It makes it easy to make system integrations.

Nachteile

Picture optimization has given us some minor challenges with receipts that wasn't readable.

- Branche: Animation

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

User friendly but still a few features to improve

Vorteile

Very user friendly and easy to integrate with Xero.

Nachteile

Still features to improve: Allow the import of suppliers and their bank details so this doesn't need to be entered manually.Their scanning system needs improvement too.

- Branche: Welthandel & internationale Entwicklung

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Streamlined Expenses, Top-Notch Support!!!

Payhawk simplifies expense management, saving us time and effort. With a few modifications, it could offer greater flexibility, but overall, it’s an excellent tool!

Vorteile

The best way to record our company expenses and is a very User-Friendly "tool"

Nachteile

While there is nothing currently to dislike, there is always room for small improvements on any platform.

- Branche: Transport/Güterfrachtverkehr/Schienenverkehr

- Unternehmensgröße: 11–50 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Awesome tool... Premium Assistance!!!

Payhawk makes expense management much easier, saving us time and hassle. A few tweaks could improve flexibility, but overall, it’s a great tool!

Vorteile

The best way to record our company expenses is with a very user-friendly tool.

Nachteile

There is currently nothing to dislike, but as with any platform, there’s always room for small improvements.

- Branche: Konsumgüter

- Unternehmensgröße: 1.001–5.000 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

better visualized expenses

total control of expenses allowing to have a secure and very strategic basis for making decisions based on expenses

Vorteile

Since I have managed Payhawk I have managed to have an order in my expenses that helps me not to forget pending invoices and to be able to have a better visualization of all daily expenses in real time on a single platform so as not to disperse the information and have control of invoices , accounts payable and receipts.

Nachteile

I like everything, however the customer service can take a while to respond, that's the only thing wrong.

- Branche: Bildungsmanagement

- Unternehmensgröße: 201–500 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk for me

I have a lot of experience as ADMIN profile but I would like more improvements

Vorteile

Very handy to understand and upload the information for cardholders

Nachteile

Quick and easy to use, But for Admind I always report issues I found and this never stops

Antwort von Payhawk

Thanks for sharing your experience! We're glad Payhawk is easy to use, and we appreciate your feedback as an admin—your insights will help guide future improvements. 😊

- Branche: Immobilien

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great tool

Vorteile

It's super easy to use and very intuitive

Nachteile

Onboarding promise to be more helpful, but you have to figure out almost everything by your own.

In Betracht gezogene Alternativen

SpendeskGründe für den Wechsel zu Payhawk

Type of pricing (subscription based) and the fact that encourages it's use by the money back program. Other alternatives price more if you use it more which is not interesting at all.Antwort von Payhawk

Thanks for your review! We're glad Payhawk is easy to use and appreciate your feedback on onboarding—it's helpful as we work to improve the experience. 😊

- Branche: Marketing & Werbung

- Unternehmensgröße: 201–500 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good but not great

General functionality is okay but having to authorise through the app to use the desktop version is silly.

Vorteile

Notifications on the platform are terrible.

Nachteile

The request notifications are the worst part

Antwort von Payhawk

Thank you for sharing your thoughts! We appreciate your feedback on notifications and the app authorization process, and we’ll work on improving those areas. 😊

- Branche: Gastgewerbe

- Unternehmensgröße: 201–500 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great System

Really enjoy the product, best I have used and looking forward to what comes next

Vorteile

Ease of use

Customer Support

Speed of onboarding

Consistent development

Nachteile

Lack of AI- perhaps lagging behind some others, but looks like some AI developments are in the work.

- Branche: Erneuerbare Energien & Umwelt

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Amazing innovative tool

very helpful tool and user-friendly platform for the management of daily expenses.

Vorteile

super helpful tool, interface user is really intuitive

Nachteile

a certain need to have self-explanatory tutorial to fully explore the tool

- Branche: Tiefbau

- Unternehmensgröße: 51–200 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Expenses simplified

Payhawk has made expense submission for me efficient and has removed the usual pain I have. The auto populate from images of receipts is probably the best I've experienced for expenses software.

Vorteile

The AI feature that can pull information and prepopulate expenses. Super handy and helps with expenses submission

Nachteile

I cannot edit an expense once submitted if I notice a mistake. Would be useful if this can be added as an option prior to approval

Antwort von Payhawk

Thanks for your feedback! We’re glad the AI feature has made your expense submissions more efficient, and we’ll consider your suggestion for editing expenses before approval. 😊

- Branche: Krankenhausversorgung & Gesundheitswesen

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Superb Software and App

Good from the start, really simple to use, quickly, on the go. Expenses can be dealt with immediately

Vorteile

Ease and speed, seemless continuity between app and desktop software

Nachteile

There's nothing I don't like. Fabulous programme, easy to use and updates on both app and software immediately

Antwort von Payhawk

Thank you for your fantastic feedback! We’re thrilled to hear that you find Payhawk easy and seamless to use across both app and desktop—glad it’s working well for you! 😊

- Branche: Unterhaltungselektronik

- Unternehmensgröße: 11–50 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great, love using Payhawk

Great, love using it. Removes paperwork, wasted time and assists accounts in expense categorisation.

Vorteile

Very easy to use, both app and desktop are seamless in helping me to submit expenses on the go.

Nachteile

would benefit from my company being able to set reminders and timed limitations on expense submission, possibly a freeze to card use until previous expenses are submitted.

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 51–200 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Efficient Expense Management Tool

Vorteile

All-in-One Expense Management – Combines company cards, reimbursements, and invoice management in a single platform.

Automated Workflows – Simplifies approvals and reconciliations, reducing manual work.

Seamless Integrations – Connects easily with accounting tools like Xero, QuickBooks, and NetSuite.

Real-Time Spend Tracking – Provides visibility and control over company expenses.

Global Coverage – Supports multiple currencies and international teams.

User-Friendly Interface – Intuitive design that makes it easy to navigate.

Nachteile

Feature Gaps – Missing integrations or specific functionalities that users need.

Expense Management Complexity – Some users feel that the expense approval process could be streamlined.

- Branche: Einzelhandel

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Easy to use platfrom

Positive, we are very happy with the product.

Vorteile

Easy to use for both finance team members and the wider team

Nachteile

Sometimes there are issues with receiving fund to the account, but these are always quickly resolved

Antwort von Payhawk

Thank you for your feedback! We’re glad Payhawk has made it easier for your team to use, and we’re happy to hear any issues are quickly resolved. 😊

- Branche: Informationsdienst

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Amazing platform for managing expenses!

Really quick and efficient. The platform is so modern and has made my life so much easier

Vorteile

The app is great and prompts you to upload your receipts. The approvals are pretty much instant and super handy to have the credit card linked with it also. Honestly this has made managing expenses for my team so much easier.

Nachteile

Nothing so far. I have been using the platform for a few months and haven't had any issues with it.

- Branche: Verbraucherdienste

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

No more chasing employees!

The overall experience has been pleasant

Vorteile

The ability to place limits on cards and introduce spendature policies for different team members. The system also automatically blocks cards when employees do not upload receipts, which means everyone keeps on top of this because they do not want their card blocked!

Nachteile

I would have preferred the ability for a 'pocket function' to allow employees to pay back money that is outside company policies. Currently we need to dock these amounts from payroll,

Antwort von Payhawk

Thank you for your review! We're glad Payhawk helps with card limits and receipt management, and we’ll take your feedback on the "pocket function" into consideration for future updates. 😊

- Branche: Immobilien

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk - Well done

10/10. Payhawk is user friendly, support is great, new features are added all the time and it is a pleasure to use.

Vorteile

We integrated Payhawk into two of our property businesses at the end of 2022 and it has streamlined expenses superbly, reducing error and labour cost exponentially.

Nachteile

I don't like that fact I did not implement it sooner

- Branche: Schreiben & Editieren

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Best quality for value

I would recoment it, It is very helpful.

Vorteile

The app is very friensdly and easy to use.

Nachteile

Sometimes the app crashes, but the suppert team is very helpful.

- Branche: Marketing & Werbung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

A great upgrade for cost reporting

A great upgrade on our previous tools and processes, on-boarding was also simple to understand and allowed us to make the most of it from day one.

Vorteile

massive time saver, it has give us fantastic visibility on expenses and prompted a lot of clearing up

Nachteile

I would like to see more integrations with other platforms to make it even more seamless

Antwort von Payhawk

Thank you for your feedback! We're thrilled to hear Payhawk has saved you time and improved visibility—your suggestion for more integrations is definitely noted for future enhancements. 😊

- Branche: Medizinische Geräte

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk is for you!

Overall, it's a good experience; the reminders to upload the receipts are helpful.

Vorteile

Easy to use, especially on a Laptop, since you can drop the receipts.

I like the tool to ameliorate the photos of the receipt.

Nachteile

No Credit Card reward point program.

Delays allowed to upload the receipts are relatively short.

Antwort von Payhawk

Thanks for your feedback! We're happy you find Payhawk easy to use and appreciate the receipt enhancement tool—your input on receipt upload delays is noted! 😊

- Branche: Marketing & Werbung

- Unternehmensgröße: 11–50 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Payhawk fait le job

L'utilisation des cartes virtuelles fonctionne bien.

La remontée des dépenses de manière automatique fonctionne bien.

Le détail des dépenses est clair.

Le système de remboursement fonctionne bien.

Le support est réactif

Vorteile

Payhawk est une solution de paiement moins chère que ces concurrents et qui fait le job.

Nachteile

Payhawk a besoin d'améliorer l'UX de son application web.

Par exemple, il n'est pas toujours clair sur pourquoi une note de frais n'a pas toutes les informations nécessaires pour ne plus être dans la zone "en attente"

Antwort von Payhawk

Hi there! Thank you for your review and the feedback provided!

We're committed to improving the experience of our clients and your input will be delivered to our Product team.

- Branche: Bau

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Overall extremely satisfied

Vorteile

The customer support team is always prompt and efficient in answering any queries or concerns we may have. The integration with Xero is seamless and works very quickly. It saves a lot of time and effort when it comes to managing our finances and processing our month end. Payhawk also encourages employees to submit their receipts, saving us time from chasing them. Throughout our experience, we have not come across any problems or issues when it comes to making payments through Payhawk. The entire process has been smooth and hassle-free, allowing us to easily settle invoices and manage our finances efficiently. Overall, our experience with Payhawk has been outstanding and we highly recommend them.

Nachteile

One important area for improvement for Payhawk is streamlining the approval process for invoices. Currently, the system requires individual approval for each invoice, which can be time-consuming. Implementing a bulk approval feature would be a significant enhancement, allowing users to approve multiple invoices at once and saving them valuable time and effort.

In Betracht gezogene Alternativen

Spendesk- Branche: Gastgewerbe

- Unternehmensgröße: 201–500 Mitarbeiter

- Monatlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Expense tracking made easier

Payhawk is a great tool for managing expenses efficiently. The automation features and integrations help simplify tracking and approvals, making it a convenient solution for daily use.

Vorteile

Payhawk makes expense tracking incredibly easy with its intuitive interface and automation features. I love that I can add my company card to Google Pay, which makes payments more convenient. The receipt scanning and approval workflows also streamline our processes, saving time on reimbursements and reconciliation.

Nachteile

The receipt scanner could be more accurate and responsive when capturing details.

Antwort von Payhawk

Thanks for your feedback! We're glad Payhawk is helping streamline your expense tracking, and we appreciate your suggestion for improving the receipt scanner’s accuracy and responsiveness. 😊

- Branche: Kunst & Handwerk

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Reccomend for all companies

very good, we have implemented it on all of our CC activities

Vorteile

platform, overall car management. Very simple and easy to use

Nachteile

export system, doesnt always automatically link payments to exact

- Branche: Bau

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great App to run your business

Efficient finance management, user-friendly interface.

Vorteile

Streamlined expense tracking and easy integrations.

Nachteile

Limited features for small businesses’ needs.

- Branche: Bildungsmanagement

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Love the ease of use!

Uisng it now for several months with not a single issue.

Vorteile

Very easy to use app, great with Google pay and Amazon. Love the ability to picture reciepts direct to the expense.

Nachteile

Almost nothing so far, i only use the app so no physical card.