Kashoo

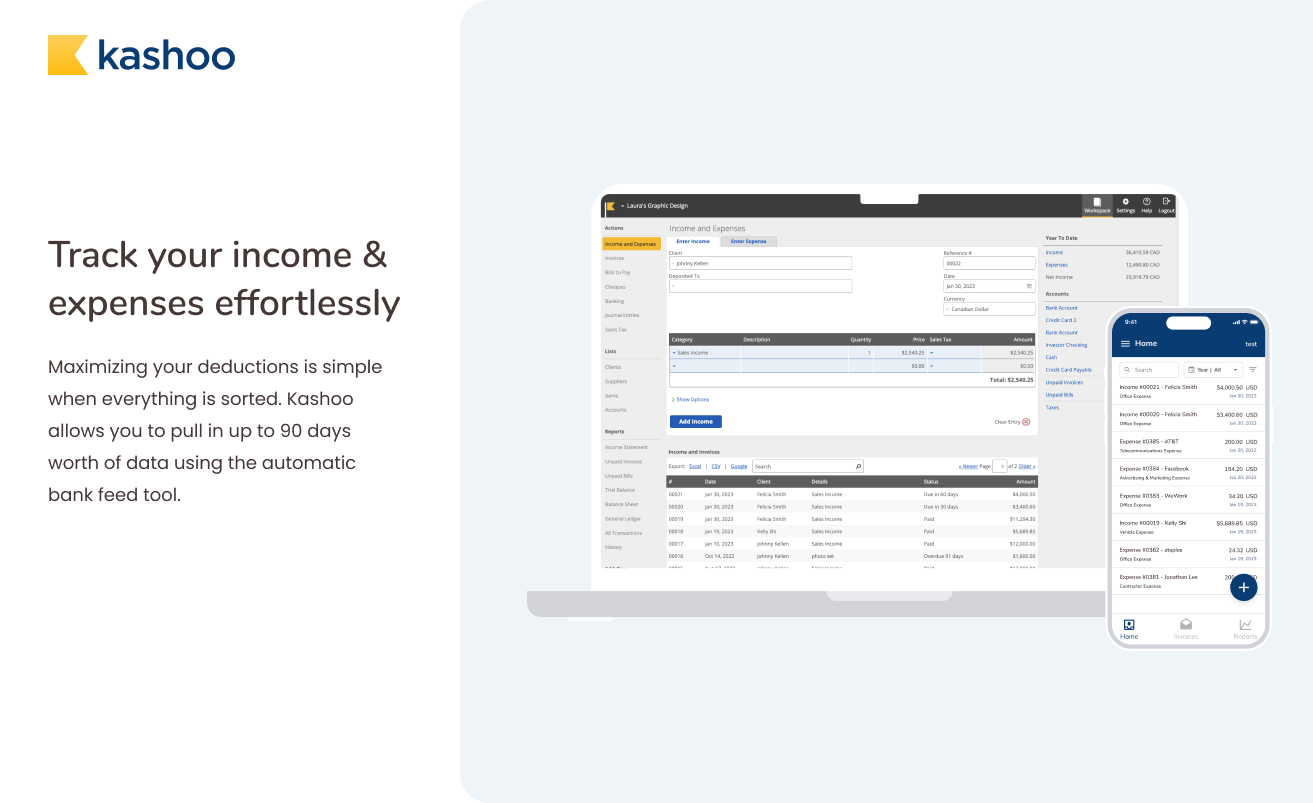

Über Kashoo

Kashoo Preis

Kashoo bietet keine Gratisversion, aber eine kostenlose Testversion. Die kostenpflichtige Version von Kashoo ist ab 20,00 $/Monat verfügbar.

Alternativen für Kashoo

Alle Bewertungen zu Kashoo Filter anwenden

Nutzerbewertungen zu Kashoo durchsuchen

Alle Bewertungen zu Kashoo Filter anwenden

- Branche: Personalbeschaffung & -besetzung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo - easy to use and does the job.

A very pleasant experience and an easy learning curve.

Vorteile

I purchased Kashoo on a LTD with Appsumo a few years back. It is a great piece of software, handling your accounts and bank feeds splendidly. It's easy to get used to and you can be sure your records will be accurate for those that want to see them.

Nachteile

I was not doing VAT in the early days, so not sure how Kashoo handles this. My new accountant uses a different package, so had to move across to that—otherwise, not a problem to have carried on.

- Branche: Einzelhandel

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo Equals Kaching!

Vorteile

Kashoo prides itself on being the world's "simplest" accounting solution. After using the software, I agree. The software is beyond user friendly. It met and exceeded all my accounting needs. With invoices and payments, I am getting paid within two days, as opposed to close to a week with another software I used.

Nachteile

I am unable to find any complaints about the software as of right now.

- Branche: Elektrische/elektronische Fertigung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo - The worst accounting software, 6 years running.

Very slow program, great time wasting software.

Now using, Zoho accounting.

Zoho is working much better, no duplicates and a much faster program.

Vorteile

Very Easy to use. Any body will be able to usr program.

Reconciling bank statements can be temperamental, very slow.

There are much better programs around. No need to waste time on this program.

Nachteile

I have used Kashoo cloud accounting for 6+ years.

The Data bank feeds have faulted on many occasions, causing duplicate bank entries, upto four entries for one transaction. This is extremely annoying and very time consuming, as each duplicate has to be removed one at a time. I spoke with the Kashoo team, their support is rubbish and incapable of fixing the problem, nor could they explain the reason why this has occurred. It would be bad enough for this fault to occur a one off. Unfortunately, this has happened four times in the last six years.

I am too Happy to say, Goodbye Kashoo!

Zoho is working much better, no duplicates and a much faster program.

- Branche: Krankenhausversorgung & Gesundheitswesen

- Unternehmensgröße: 5.001–10.000 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo simplifies project, payroll, and cashflow administration

It's dependable and steady, and it even works with an earlier version of my web browser. It doesn't have a lot of showy features, but it performs what it has to accomplish. Many other online programs are constantly evolving and require a lot of upkeep. For the general simplicity of the app, I'd say it's easy to view everything at a glance, and the user interface isn't too complicated.

Vorteile

My favorite feature was the ability to quickly reconcile your bank accounts. Auto-import is another feature offered by Kashoo for a variety of transactions. Everything you need to run a small company or side hustle may be found in this app. For the limited business accounts, my accountant found all she required.

Nachteile

To improve the user experience, the program requires various updates, such as enhancing on-app tutorials. Because it does not account for VAT, it is not appropriate for those who are VAT-registered in the UK. You may also upload csv files from a few UK bank accounts.

- Branche: Rechtsberatung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great Software--If You Don't Need to Connect Any Bank Accounts

Ideally, Kashoo would be that accounting software that provided accurate cash flow statements and analyses that were no older than 2-3 days, and would include not just bank account transactions, but also credit card spending and transactions. In our office, any bills or charges that are setup for automatic payments or auto-pay are linked to credit cards, rather than our bank account(s). If I could get Kashoo to function properly with our credit card AND bank accounts, then I would save myself and our CPA tremendous amounts of time and paper clutter at tax time because I could provide statements or reports from Kashoo with itemized expenditures for all accounts. Alas, until Kashoo can resolve its synchronization issues with our financial institutions, then I'm forced to go through and annotate each credit card statement with the expense type, etc. then email or fax each statement to our accountants...

Vorteile

After reading so many great reviews about Kashoo and its comprehensive but UX-friendly accounting features, I was super-excited to purchase a steeply discounted subscription/membership on App Sumo several months ago. I was particularly looking forward to being able to sync multiple company bank accounts, as well as our daily credit card sales from Square POS, in a single application. The Square/SquareUp integration is among Kashoo's strongest features in my experience, as I can't recall any synchronization issues or glitches accessing Square data in Kashoo. It also has an iPhone app that's fairly functional, albeit wholly utilitarian in its look and feel. However, considering how much data and memory are consumed when running most accounting programs, the Kashoo app manages to be easily sync-able and fast, which I wasn't expecting...

Nachteile

Connecting bank accounts and accessing transactions has been a thorn in my side from Day One. I've tried multiple browsers--Chrome, Firefox, Opera, Safari, etc.--and tinkered with firewall and security settings far more than I probably should trying to get Kashoo to work correctly with operating account at PNC. I don't know if it's because of the number of transactions or the fact that there's a secondary trust account attached to PNC's online business banking, but I cannot get some of the most crucial bank and credit card accounts to work properly on Kashoo. I've also had issues with credit card accounts and have tried deleting and reconnecting accounts so many times that I'm to the point where I haven't even attempted to open Kashoo in weeks.

In Betracht gezogene Alternativen

QuickBooks EnterpriseWarum Kashoo gewählt wurde

Wave was great--at first... But the more transactions and account data were synched and/or uploaded, the slower and more sluggish it got. Also had a bad experience using their credit card processing system/feature (they refunded a customer's money without notifying us beforehand because apparently they were prohibited from servicing businesses in our sector) which forced us to seek out budget-friendly, feature-rich alternatives for our small business.Zuvor genutzte Software

Wave- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 501–1.000 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Easy to use Accounting Software

It was awesome as it really improved our business operations and brought in efficiency. Our Customers & Salespeople all were equally satisfied using this platform

Vorteile

This is a very easy to use, not so complicated, simplified Billing & Accounting system. Adopting to this software is very easy and it gives you plethora of integration options.

Nachteile

When the user numbers increase, this software may get a bit costly for you and lags a bit when concurrent users are using this application.

- Branche: Unterhaltung

- Unternehmensgröße: Selbstständig

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Amazing alternative to Wave & a better value than Quickbooks for freelancers & small businesses...

I love using it for most of my freelance needs: Accounting, Expenses, Project budgeting, credit card payments, and tax management.

Vorteile

Tax Management, Real-Time Bank Feed, Bank reconciliation, and Project Budgeting are just some of my favorite features, web and mobile apps are a bonus but the cherry on top for me is that they support the Spanish language as well. Not to mention the super fast support.

Nachteile

Not many cons but I am just hoping for more integrations. Specifically invoicing software like Fiskl!

In Betracht gezogene Alternativen

WaveGründe für den Wechsel zu Kashoo

The amazing support, the mobile app, and the constant updates and feature upgrades.- Branche: Fotografie

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good alternative to Quickbooks

Kashoo is helping us keep all our finances straight. We run all our accounts receivable and accounts payable through Kashoo to keep up with our bottom line.

Vorteile

I like their online tutorials. I have zero accounting experience, but Kashoo's tutorials have helped us to understand what and how we need to track our business finances.

I also really like how detailed it it once you get the hand of how to use it. I can see at a glance how we are doing financially.

Nachteile

There is a pretty steep learning curve, especially if you don't have any accounting experience at all. I found it to be very, very confusing. The tutorials helped, for sure, but there was still a lot of back and forth with customer service who seemed to get annoyed with all our questions, especially since we have NO accounting experience.

- Branche: Fotografie

- Unternehmensgröße: Selbstständig

- Monatlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good alternative to QuickBooks for small biz, but no UK bank connection

Vorteile

It's simple with a good user interface and has everything you need to manage a smaller business or side hustle. My accountant was able to find all the things she needed to do the limited company accounts.

Nachteile

It doesn't calculate VAT so it's unsuitable if you're VAT registered here in the UK. Few UK bank accounts connect too but you can upload csv.

In Betracht gezogene Alternativen

QuickBooks OnlineGründe für den Wechsel zu Kashoo

We use Quickbook Online for our agency and for my other business I use Kashoo due to lower costs.- Branche: E-Learning

- Unternehmensgröße: Selbstständig

- Monatlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good Value for the SoloEntrepreneur

I've been doing my books in Excel for years, but have gotten to a point where that just isn't working for me anymore. I needed an accounting software solution and didn't want to go with the one I've been using for personal expenses due to personal beliefs. Then I heard about Kashoo. It was affordable. It looked fairly easy to learn and robust enough to grow with me. I haven't used it much yet, but I really like what I've seen so far.

Vorteile

The software is relatively easy to use for a beginner. It also looks like something I can grow with and even pass on to an accountant once my business has grown large enough.

Nachteile

There is a bit of a learning curve and I'm not able to import information the way I was hoping to.

In Betracht gezogene Alternativen

QuickBooks EnterpriseWarum Kashoo gewählt wurde

My business was getting sophisticated enough that a spreadsheet just wasn't cutting it anymore.Gründe für den Wechsel zu Kashoo

I discovered that Quicken supports organizations that go against by religious beliefs and do not want to have my money go toward those causes.- Branche: Kosmetik

- Unternehmensgröße: Selbstständig

- Täglich für Kostenlose Testversion genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo

Vorteile

I like that you can attach your bank account and see all transactions in the inbox. It makes it easier than having to navigate my banking app as well

Nachteile

The integration is a problem for me. If they could expand how many apps they can integrate with, it would be helpful.

- Branche: Immobilien

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great software for people building their business

For 90% of small business of 10 emplohees or less, Kashoo is the way to go. It feels light, utilizes the Cloud for storage, has terrific support, and is easy to learn and utilize. Im comfortable in growing my business, and letting Kashoo grow with me.

Vorteile

The key in selecting accounting software is not how much it can do for you, but how much support you can get after you take the plunge.

With Kashoo, the support is unbelievable. Utilizing their Chat feature will get you a satifactory answer in a matter of an hour or so. I've never felt like I got a less than complete reply. Why? Because they know their product, and are not paid to sit and answer questions all day long about something they don't use. I cant say that for the other software systems I've tried. I'm now running 3 businesses off of Kashoo.

Nachteile

The bank feed somehow gets hung up each month...not sure why. Wish there were more check templates that utilize a common standard (QuickBooks, MS Money)

Wish the Client fields were more customizable, so reporting could be more robust.

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Superb, snappy, comprehensive!

When I set up my business 5 years ago I knew I would need an easy-to-use accounting system. As an accountant myself I needed one with all the bells and whistles, and as a business owner I needed one that was easy to use from anywhere and fast and flexible. After experimenting with a number of unhappy options, I stumbled across Kashoo and it was love at first sight.

Vorteile

Clean, snappy interface; support for serious accounting (adjustments, transfers, trial balance, general ledger, supporting documents) over and above simple receipts and payments; cloud-based & browser-based so allows me access from anywhere and peace of mind regarding data security and backups. And I can share it all with my auditor sitting miles away at his Windoze PC so he doesn't have to take up space in my home office, where I happily update Kashoo using my iMac :)

Nachteile

Maybe a tad more support for drag-and-drop would be nice as would the ability to open it in multiple windows so I can cross-check and tally stuff a bit easier than going backward and forward in the same browser window.

- Branche: Großhandel

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Software which solved all operational tasks

Was using Kashoo every day and thanks to it I knew every cent is counted and on its place!

Another thing I liked very much - nice reports!

Vorteile

Have been using this software for 2 years. In an environment of limited staff this software really helped to control cash flow, expenses, invoices, salaries etc, by only one employee (not dedicated).

Nachteile

From the very beginning it was very easy and logical to deploy. Learning took no efforts. It was smooth and very flexible.

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo Online Accounting Review

Again, for the money it is suitable for small companies.

Vorteile

We started using this product because the first year was free through Liberty Tax Service. Additional account costs are attractive. So cost is what I like most about the product. I do like the layout/appearance of the P&L and Balance Sheet. Also like the Bank Connect feature.

Nachteile

Inability to get totals within the apps modules, limited reporting capabilities, unable to filter by date, name, detail, etc. Wish this product was a bit more robust, so that exporting to Excel wouldn't be necessary.

- Branche: Marketing & Werbung

- Unternehmensgröße: 11–50 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

A complete financial solution with custom support

Kashoo has made accounting simpler for us, specially with custom financial management support by Kashoo tema makes this application perfect for small companies.

Vorteile

Management of project expenses, payroll expenses & cashflow management are so simple to use with Kashoo.

Nachteile

Using invoicing system and tax implementation for countries outside US is not that friendly.

- Branche: Programmentwicklung

- Unternehmensgröße: Selbstständig

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great accounting software that does everything I need

I use it to run several businesses. It is easy enough that I can use it myself while running my business. I can send invoices and take payments. Whenever I have a question, I can chat with customer service.

Vorteile

Intuitive design. Clean and uncluttered layout. Everything just makes sense. Customer service is fantastic!

Nachteile

I would like to see updates more frequently.

- Branche: Restaurants

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo Online Accounting

Kashoo is one of the small companies that is competing with the big guys. Their support is fantastic, their product is easy to use and constantly updated for features and usability. You can do it from your desk, from your tablet, or from your phone. Personally I do all 3!

Vorteile

Very simple and does almost everything the giant products on the market do.

Nachteile

Really could use some more color. But that's just me, I like color.

- Branche: Konsumgüter

- Unternehmensgröße: Selbstständig

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Easy and beautiful!

I really like being able to do everything on my iPad. I also love the customer service by phone is key and email is great to. Finally I love giving password to my accountant and I'm done!

Vorteile

iPad app

Nachteile

invoicing is a little fussy and the graphics are a little complicated.

Need to make it easier to identify and manage unpaid and past due invoices

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

The only real alternative to Xero

I have been using Kashoo for a few weeks now.

The product itself works great and is easy to use, though some features could be more intuitive (double taxes for e.g.)

Support is awesome - and the solution is highly configurable.

I have tried Wave and Quickbooks before - If you are in Canada - this is certainly the way to go, as this has Canadian payroll integrations built in (hint: there is more than payroll provider you can use !)

This is the only real competitor to Xero (which I haven't tried).

Amazing!

Vorteile

- So far - everything is configurable

- Great online documentation

- Integration with payroll

- The service is amazing

Nachteile

- Some features are not out of the box or not intuitive enough, so you have to ping-pong support even after browsing through documentation.

Luckily, support is amazing and answers politely, accurately and within a few hours.

e.g.:

- Double taxes which apply in some provinces - was able to figure it out with support

- French Invoices (hey, we're in Canada and Kashoo is Canadian!) - was able to figure it out with support (had to do the HTML myself, but the tool permits that which is better than Quickbooks and Wave I have tried before)

- Branche: Konsumgüter

- Unternehmensgröße: Selbstständig

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Flexible software

One of the really good things is that you can use the software in a simple way but it can also grow to include more features. Means that you can get to grips with bookeeping and add function as you and your business grow

Vorteile

It's flexibility

- Branche: Konsumgüter

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo for a small company

Top draw other than above.

Vorteile

It’s very user friendly, fairly priced and always available

Nachteile

Email function needs fixing (can’t send email invoice without getting rid of > this at the end of address ) in field. Reporter problem to no avail

Also, it would be nice it store scans or have a folder on customers. Otherwise, very good.

- Branche: Sport

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Excellent Customer Service is their Winning Point!

Vorteile

I love this app because it is

- simple to use

- no technical skill needed

- IOS app to record the expenses at any time

Nachteile

This is not a must but if it can be done then it is perfect.

Need to integrate with Payoneer.com

-

Quelle der Bewertung

Mehr Details anzeigen

Very good app with affordable price

I do appreciate your application, it's easy to use and track.

anyhow, there are more functionalities that I really need.

- need to have a weekly income vs plan graph feature , we can put our monthly plan or yearly plan of income then app can breakdown into weekly target. then graph help compare the income and the trend of the plan in each week. So, people don't need other financial app to fill their target vs actual just to see the trend of their planning.

- need the mass update on the payment status. i have a problem when i have to change status from 'due on receipts' to "paid" , this is when i need to update 10-30 transactions at one go.Or you may have solution already only that i didn't know. So, you can suggest if you have solution in place.

- for the export file to Excel, anyhow the database does not filled in every cells, since you will keep some cells blank if they are the same category e.g. terms of payment account. i have to use excel function to fill all cells before i can do a pivot table to analyse my data.This pre work with filling all cells really waste my time. i need a complete database exported. So, that i can filter or pivot right away after exported.

- Branche: Non-Profit-Organisation Management

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Making it Happen with Kashoo

The cloud based operational system enables access by key partners as well as the ability to enter current information, regardless of time or place. Under Kashoo Features the "Create and track project costs" has allowed us to monitor multiple discrete activities in a singular fashion.

Vorteile

Kashoo's user friendly, intuitive layout and extensive support base enables a novice to get up and functioning in a relatively short time frame.

Nachteile

The addition of a budget segment would enable a nice comparative feature. Currently I am unaware of such an feature in Kashoo.

- Branche: Computer-Hardware

- Unternehmensgröße: Selbstständig

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo was the easiest web app to go to from my traditional personal computer accounting system

Very good, once I learned it all.

Vorteile

It's reliable, and stable, and it works with my older web browser ! It doesn't use too much flashy stuff, and it just keeps working. Many other web apps keep changing and need constant browser upgrades and a lot of maintenance. After that, I would say the overall simplicity, you can see everything from the top page, the user interface is not too deep or busy. The "back" buttons are very helpful, browser back buttons often get confused, or lose context. I'm an old-fashioned double-entry, journal and T-accounts type, but I have found that it is all really there, just sometimes called something else, or underneath something else. But once I found everything, I became productive in the system.

Nachteile

Not a con, but a feature suggestion - I'd like to have an inventory system, a parts database - is this available as an option, or is it there somewhere and I haven't found it ? I don't need anything too fancy, just part numbers and costs, I used to use a system that allowed me to keep a running average cost on items, because every time I made a purchase of an inventory item, it added to the total of parts on hand, and the total of cost for that item, and then also debited Cost of Goods Sold. At inventory reconciliation / period closing, I then did a journal transaction adjusting the parts left to an inventory asset account, at the average price, leaving Cost of Goods Sold representing the cost of the goods that actually left after purchase. Or it could be the other way around, going to inventory first and then getting adjusted to COGS, but I found that this way was most convenient, because most parts were purchased in order to make something to sell, and only certain items are ones I keep a surplus of, to weather availability issues (although that's more the norm right now). Right now I do the process described above manually.

- Branche: Einzelhandel

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Perfection (Almost)

We absolutely couldn't run our business as efficiently as we do without Kashoo. It allows us to be agile and respond to our customers' needs in an instant if necessary. We've had many of our larger customers ask us if we could help some of their other vendors to get better organized. With the help of Kashoo, we've set the bar for others to reach.

Vorteile

We've been using Kashoo for many years. The ease of use is amazing. We know exactly what is happening in our business at any given moment. Although we typically don't use the mobile apps, they are useful if your business model is more suited to mobile. The web app is solid. Uptime is impressive. Support is quick and thorough.

Most users wouldn't notice but when you get a bit outside the box you're going to need some assistance from the support team. Some tasks are quite involved when you get past the ordinary. No worries though, the support team is there to guide you through.

What we like most is the flexibility of the software and the multi-user capability.

Nachteile

Dealing with vendor credits is a pain when you pay by cheque. We would really like to have some inventory control tied into invoices. The new statement feature is nice but we would like to have control over the fields displayed in the report. In particular, we would like to be able to have our customers' PO numbers listed so that they can more easily cross reference our invoices.

- Branche: Automotive

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Not good

Where do I even begin? Kashoo’s bank feeds fro my credit card show up in USD, even though the card is CAD. They had no fix for this, so the feed became largely useless. When I purchased the software on a lifetime deal, I was told I would be able to upgrade to Kashoo 2.0, an upgraded and improved product, complete with machine learning for automatic categorization of imported transactions. As it stands, Kashoo is quite clumsy and time-consuming to use. Each transaction has to be manually dealt with; there are no features that allow bulk or automatic categorization. Kashoo 2.0 materialized for a brief period, and then became Trulysmall. When I finally requested to have my subscription transferred, I was told that wasn’t an option. Without major upgrades, Kashoo is unbearable to use. Stick to the other tried and true options out there. They might cost more, but surely an additional 5-10 hours of your time per month is worth the extra $10-20 you’ll pay to get real accounting software.

Vorteile

It's inexpensive, that's about it, it's not good.

Nachteile

Clunky, lacks many features of its competitors, time-consuming, bank feeds don't always work

- Branche: Marketing & Werbung

- Unternehmensgröße: Selbstständig

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Easiest Accounting/Bookkeeping software by far!

The company is very responsive and the software / apps have been solid. Kashoo is my third (and final) accounting software service purchase.

Vorteile

Here's the thing - I HATE accounting & bookkeeping. So I want to spend the least amount of time doing it. And, I want to spend even less time doing taxes. Several years ago, I researched all of the solutions out there, yeah QB too... but I dreaded a steep learning curve and wanted something accurate - and portable. Kashoo has the app for my phone & tablet so I can whip out an invoice real quick while visiting clients. It downloads from my bank just like the other big names, and even has an option to accept credit cards from my clients. It's really powerful, and if you're a numbers geek you'll have fun with all of the options. But for me - it just works. Online or app - I don't wonder about my numbers anymore, nor do I waste a bunch of time. And they do regular webinars which are actually quite interesting. Almost makes me want to do my bookkeeping. Almost. lol.

Nachteile

There's really not a lot to dislike about the software, and the support staff is great. If I could change anything, I'd have them move their headquarters from Canada to the U.S. ;)

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Kostenlose Testversion genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo Does Not Measure Up

Lacking an estimates function is critical to all small service businesses - this is the biggest down fall of this package. Then, you add the cost of $27 a month or $30 month-to-month and Kashoo is now way above its competitors in pricing and features - I cannot justify this as a viable package for accounting. QuickBooks Online, WAVE, and Patriot offer better packages for less money -- look elsewhere.

Vorteile

Like other online accounting software packages, Kashoo offers receipt and transaction matching as well as automatic reconciliation. Their invoicing and general ledger is well done and works well. Same as the other packages, Kashoo is available as an online accounting package only - which is great - allows for anytime, anywhere working.

Nachteile

Two major items missing are accounts payable (I know Kashoo will say very small businesses use a debit card, credit card or writes a manual check), however having an AP system to collect your vendor bills is kind of a no-brainer. The other item is a lack of being able to do estimates - this is critical as small service businesses propose jobs all the time and if your accounting package did estimates, all you would need to do is finalize a few adds and subtractions from you customer, click "turn into an invoice" and email to your customer - takes no time at all and everything is in one place - quick and easy. And there is no budget feature (which is probably minor to many small businesses).

Antwort von Kashoo

Hey Craig!

Thanks so much for taking the time to submit your review for TrulySmall Accounting!

We wanted to let you know that we've since added AP to our software, and we're sorry your experience was less than optimal.

We are still working on our product roadmap so hopefully, we can tackle some of your other issues in the future.

Really appreciate your feedback!

- Branche: Landwirtschaft

- Unternehmensgröße: Selbstständig

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

love the user interface and chat feature!

When I first started my horticulture business (capterra- why is horticulture or even landscaping, not an industry option?!?) I kept books on paper and had to learn book keeping from the IRS website and other online (free) resources. When I decided that I really wanted to go digital, I tried multiple online book keeping softwares before finally settling on Kashoo. My experience has been really great! Every time I have a question it has been either easily answered through the online tutorials or by using the Kashoo chat feature. Even when I make a stupid mistake, customer service always seems happy to help me unravel and correct it.

For comparison, another organization that I was on the board of uses quick books and every time I had to use it I was more greatful for Kashoo! For someone who didn’t learn book keeping on quick books- looking through the accounts to find the information I need on Kashoo is so much more intuitive.

Vorteile

Ability to view accounts, excellent customer service, helpful tutorials

Nachteile

for me there really haven’t been any cons. That said, my accountant had never heard of it- not really a problem, just disappointing to me, and of course I would love to pay nothing for bookkeeping 😉

- Branche: Marketing & Werbung

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo Much better than some of other choices

My overall experience has been great. I paid one time and eliminated any monthly payments. It is very reasonable for the price and works as well as high-end programs.

Vorteile

it is very inexpensive and it takes care of everything that I need to be done from accounting software.

Nachteile

It can be difficult to download transactions so they can be accounted for in the business. However, it is still very efficient.

- Branche: Kosmetik

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Review kashoo

I can see up to date my statement income monthly or yearly and compare, so i can adjust strategy when i want. Program everything up front bills. Find receipt paid , clients that buy on credit, when to call them. Bills to pay.

Can comepair booking with my bank statement, do monthly tax payment, download documents in exel, pdf etc

Vorteile

Its a simple to use day by day administration program. 24 hours eccess any where in the world. Get all financial information how your business is doing.

Nachteile

If your not good in english it will be hard to understand most instruction , like setting up certain things to get going, personaly i dont go to deep in setting up complicated administration things i dont understand, but when i have to you can get online help , only on working hours, not 24 hour. Maybe some more after hours asistance can come out handy, depens in which time zone you living.

- Branche: Marketing & Werbung

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

I consider Kashoo to be a trusted partner in my business

Overall Kashoo is a 5 star business. I only gave them 4 stars for features and functionality because no software is ever complete. For example, the mobile receipt capture software doesn't read my receipt and fill in the data entry for me. (Hint Hint kashoo - feature request)

The apps for mobile and iPad are great. I'm able to get everything done and stay up to date easily. The mobile capture works great and means no more piles or receipts lying around. The Web UI was recently updated to add the feature to import scanned and digital receipts too - a specific feature request of mine.

Kashoo is always investing in the development of the tool and the education of their customers. The addition of Kashoo U was great for education. I also take advantage of live chat and the always on knowledge base.

My accountant even became a Kashoo MVP which I was thrilled about. I like that I can give my accountant permission based access to the data to adjust and file.

Vorteile

Ease of setup, ease on use. Archiving and security of data.

Nachteile

I like everything about it, but encourage further development of the mobile capture services. There's still room to improved workflow and save customers time and money.

- Branche: Automotive

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

My Kashoo Experience

I Love Kashoo but I wish there was more help online, I'm trying to figure out how to deduct money from an employee for a garnish of wages and I thought I did it correctly but it was wrong, because I'm a really small business and have less than 5 employees I can not get any help. I also wish that the invoice section of Kashoo was easier to use. But It's way more user-friendly than other programs! So yes I like it !!

Vorteile

Easy to use, easy to keep track of things, like the reminders it gives in the side column

Nachteile

Invoicing is not that great, or it could be that I'm not knowledgeable in creating invoices in Kashoo. Wish there was more help for the free accounts, but hey can't get much for free these days.

Antwort von Kashoo

Hi Carrie, thanks for the review! Kashoo offers many support options and our team is ready to help you any time you need it - by phone 1-888-520-5274, by live chat that's available from within the app, by email at [email protected], and through our self-serve support site at support.kashoo.com. We also regularly host live webinars. You can visit kashoo.com/webinars to see what's coming up. I hope that helps!

- Branche: Musik

- Unternehmensgröße: Selbstständig

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great Canadian Accounting software

I've used Kashoo to track my finances as a professional musician for a few years now and it has never let me down. It's very fast to get in and out and do what I need to do. I love being able to support a Canadian company, in Canadian dollars :) Support has been very responsive when I've needed it.

Vorteile

Kashoo is very clean and lightweight. Not flashy, but that makes navigating the web app and iPhone app snappy.

Nachteile

Lacks some of the bells and whistles of the 'big boys' in this space - like integrations with other services. That's not something I need right now, but could be useful in the future. Kashoo's design can seem lacklustre at first. There's power in that, but it's not nearly as friendly-looking as Freshbooks, for example.

- Branche: Unternehmensberatung

- Unternehmensgröße: Selbstständig

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo makes my CPA happy

I use Kashoo daily to keep track of my business income, expenses, and invoicing.

Vorteile

Kashoo is easy to use. It's easy to invoice my clients by sending them invoices directly via Kashoo. It's recommended by my CPA and the reports make him happy.

Nachteile

I would love to be able to set up recurring invoices but Kashoo doesn't offer recurring invoices. Maybe in future?

- Branche: Eventservice

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Great support

overall very good

Vorteile

Customer support has been excellent. easy to use

Nachteile

invoices are the most important thing. They are how we present the Kashoo product to our customer. The invoicing needs more functionality. i.e.: I need to be able to delete a line or line items and I can not. Not being able to do this can make an invoice look sloppy.

if a client is tax exempt I have to make every line item a non tax item - better would be one bulk action, one button that says customer is tax exempt.

I would also like to see a quote or estimate option. If a client wants pricing, I need to send them an invoice. if the client decides not to go with us, that invoice is counted as income.

- Branche: Schreiben & Editieren

- Unternehmensgröße: Selbstständig

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Making Finances Easier for a Solo Business

I got the program at a discount with lifetime access, so it's definitely worthwhile for that price. I can't say how much it would be worth for a monthly or annual fee. That's the only reason I don't rank it higher on the "would I recommend it" scale.

Vorteile

I've enjoyed having an easy online place to enter my income and expenses for my small business. The dashboard is pretty straightforward. I believe there are additional options I haven't explored, and they are constantly making improvements. I'm looking forward to seeing what it can do at tax time, and I fully expect it to make things easier.

Nachteile

When I have a one-time client or expense, I have to take an extra step to add them as a client before putting in the transaction info. It would be nice to have a shortcut for that, and only add them to the client/expense list if it will be a repeat. But perhaps it's hard to know for certain when that will be the case.

- Branche: Restaurants

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Basic Software at Economical Price

We are running a seasonal fast service restaurant with 20 employees with a pretty simple chart of accounts. I use QuickBooks Online for other businesses but I was looking for something less costly which integrates well with our Square POS terminal. Kashoo does a great job with Square and it is less than half the price of QBO, but with commensurately less functionality.

Vorteile

1) Automatically lists the latest entries in income or expenses or other accounts if you select them.

2) Easy to learn and to get going

3) Excellent integration with Square allowing you to run detailed excel reports to slice and dice your Square transactions to your heart's content.

Nachteile

1) Bank account transaction matching is cumbersome and a bit clunky. The top half of the page is what you've matched, and the bottom half are all the entries in Kashoo INCLUDING matched ones. The bottom half should really be just the unmatched entries.

1a) You can't run a report on matched or unmatched entries and if you select or download the bank account account it does not tell you which entries are matched.

2) It won't add up sub accounts on an income statement

3) In general, if you want to run reports the answer is excel, but excel isn't that bad: it's just a pain to dump it, format it, sort it , etc.

- Branche: Sport

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Multiyear user

Great!

Vorteile

I've been using this software for 5 books for about 5 years now. I'm not an accountant, and it's so well laid out that I really prefer this to any of the other systems I've tried. It's all put together for a entrepreneur to use easily.

Over the years I've needed support and help a few times, and each time I've had the issue resolved by a real person very quickly and easily.

Nachteile

Some of the book keepers need to get up to speed initially, but it doesn't take long.

- Branche: Buchhaltung

- Unternehmensgröße: 10.000+ Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Perfect accounting initiative for entrepreneurs

Vorteile

I liked rapid bank reconciliation feature so you don't need to worry about flowing amounts. Moreover, Kashoo provids auto-import for any type of transactions.

Nachteile

The application needs some upgrades, such as improving on-app instructions to accomplish better user experience.

- Branche: Buchhaltung

- Unternehmensgröße: 51–200 Mitarbeiter

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good software for bookkeeping

It is a great software that help people on day to day bookkeeping.

Vorteile

This software is very easy to understand for people who do not have accounting background. I taught my clients for this software and then can learn it very fast, there is always someone to help you online. Great software in the market now.

Nachteile

Some functions are confusing for example, to overwrite GST or PST. There is no formal instruction on how to perform these functions

- Branche: Buchhaltung

- Unternehmensgröße: 201–500 Mitarbeiter

- Monatlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Good software and very easy to use

We have used Kashoo to help our small business owner to get their own books. By doing this way we made less mistake on bookkeeping and saved our clients lots of money.

Vorteile

1. Very clear interface, when I show this software to our client they could easily understand.

2. Very functional, I can enter all the data efficiently, this software also remember entries.

3. Support is always there, every time I have question I can just live chat with the support and get my answer within few minutes.

Nachteile

1.for our client from china we may need different languages to help those who does not understand English able to make their own books.

2. A comprehensive training would be best for users.

3. More features helping client like scan in or suggestion entries for better client experience whenever they need support.

- Branche: Architektur & Planung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Best Accounting Solution for SME's

Being the owner of a small company with no accounting background at all made my decision to handle accounts a crazy one, but thanks for Kashoo who helped me overcome this challenge successfully! A well developed piece of software with a huge bunch of educational videos and guiding articles, equipped with excellent customer support is exactly what you look for when you are starting your first steps in accounting. Kashoo made my life easier and gave me full control over my cash flow!

Vorteile

- Ease of use

- Accessibility across different platforms

- Realtime save and backup

- Well designed interface

- Fully customizable invoices and reports

- Full-featured iOS app for iPad.

Nachteile

- Lack of a generic (non-US) payroll/HR component

- Useless android app!

- Branche: Professionelles Training & Coaching

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

So much nicer to use than many others

My biggest issue with online accounting software has been that I run three separate businesses and I have had to have 3 separate accounts using the competition and I can now check my accounting from one login. Also, I had to pay extra to allow my accountant and bookkeeper have access to my numbers but that is included in my Kashoo account and after almost 8 years with a competitor, I'm done with them. Kashoo is the future of online accounting.

Vorteile

- Everything was so simple to set up

- had all my banks, which is rare as I'm Canadian and often accounting software has either only US banks or a tough process to get my banks to integrate

- Customer service experience has been amazing!

Nachteile

It's not as aesthetically pleasing as some of the others. That's it so far.

- Branche: Unterhaltung

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

The Online Account Software for Startups

My overall experience is that my accountant loves this, and everywhere I go I automatically turn heads because this software makes me look professional even though I am a Company of One.

Vorteile

It has a very clean look and the fact that I can look at my statement very quickly is amazing

Nachteile

A step by step onboarding would be ideal.

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Easy and faster accounting program

Online assitence is great , Kashoo team have the knowlede and quicky answers when I have quesions or need solved problems

Vorteile

The online program doesn't need to update and lost the information.

I can attach imporant document in the entry and keep there.

Nachteile

-Report where shows a detail of accounts payables and accounts receivable.

- Branche: Transport/Güterfrachtverkehr/Schienenverkehr

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Kashoo Review

No problems

Vorteile

Use of navigation and pop up help topics

Nachteile

Income and Expense pages dont "spring" back to last use eg looking at entries on say page 3 for example then leave that page but have to cycle back from latest listing page to page 3

Perhaps also better prompts on what to do at year end

- Branche: Öl & Energie

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Mehr Details anzeigen

Very good for what it does, and customer support is fantastic

Good, but needs additional functionality to be super!

Vorteile

It is simple and straightforward, and gives me generally what I need.

Nachteile

I really, really need the ability to do more than just 'Projects'. I really need to be able to nest 'Projects' or use categories and classes like Quickbooks. Plus, I need to get my data into a spreadsheet much more easily.

Ähnliche Kategorien

- Buchhaltungssoftware für gemeinnützige Organisationen

- Reisekostenabrechnung Software

- Buchhaltungssoftware

- Buchhaltungssoftware für Kleinunternehmer

- Software für Anlagebuchhaltung

- Buchhaltungssoftware für Banken

- Buchhaltungssoftware für Versicherungen

- Buchführungsprogramme

- Buchhaltungssoftware für Landwirtschaftsbetriebe

- Buchhaltungssoftware für Immobilien